Life insurance in Luxembourg: how to pay less taxes?

To pay less tax by purchasing insurance products whose premiums are deductible from your return. Cardif Lux Vie explains.

Reduce your tax in Luxembourg with life insurance

Some life insurance premiums are tax deductible, allowing you to pay less income tax in Luxembourg. In order to benefit, you need to be a resident of Luxembourg or an assimilated non-resident (i.e. receive most of your income in the Grand Duchy of Luxembourg* and make the application).

Premiums paid for life insurance policy

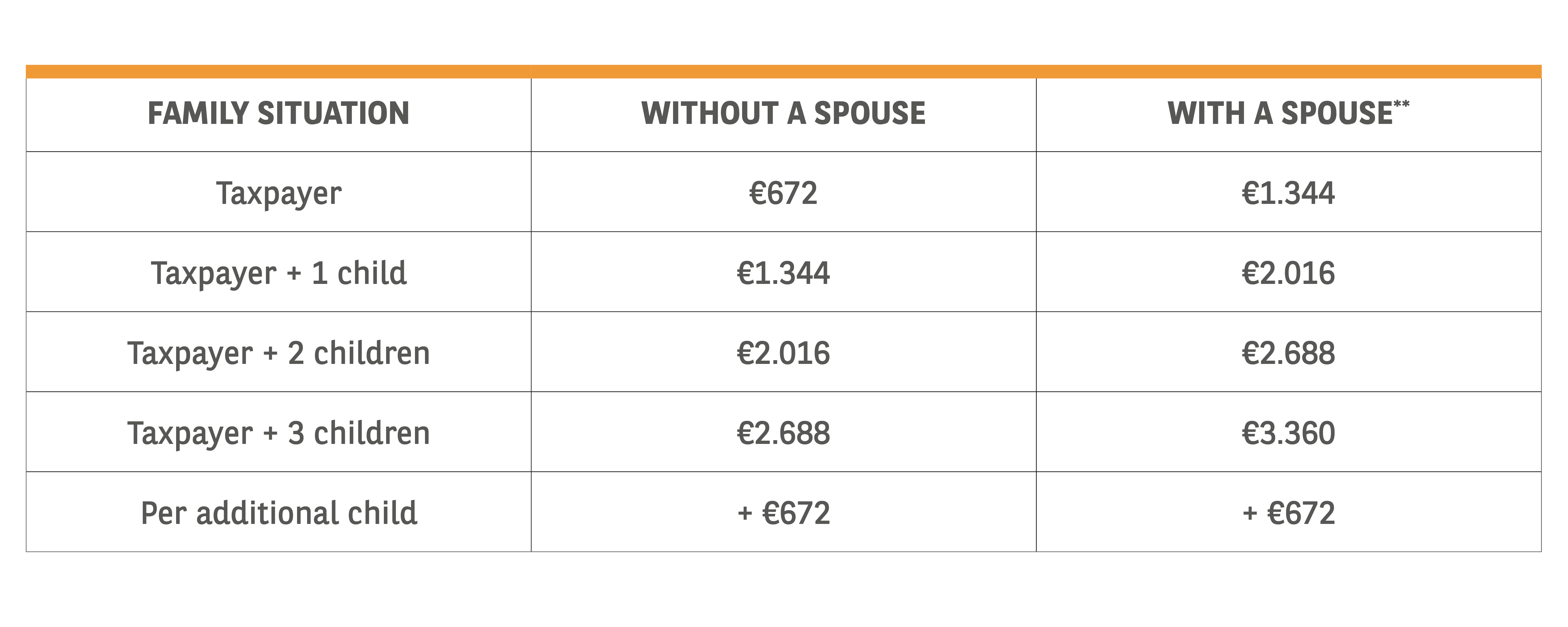

Article 109 para 1, 1a) of the Income Tax Law L.I.R. stipulates a maximum deductible level of €672 per household member for special expenditure. Article 111 of the Income Tax Law L.I.R. clarifies the life insurance policies that come within the field of application of this tax deductibility.

The insurance premiums paid for the following policies are tax deductible:

- OptiKids: the savings and provident insurance solution for your children.

- OptiSave+: the savings and provident solution that can be tailored to your needs

- Your Outstanding Balance Insurance (ASRD) with periodic premiums, the insurance solution for your home loan.

Maximum amounts deductible as special expenditure

Premiums paid for provident and pension policies

It is never too early to build up additional capital that will enable you to continue your lifestyle when you retire. From the beginning of your working life, you have the option of taking out a saving solution and benefiting from tax breaks.

The premiums paid for your OptiPension+ are also deductible from your taxable income under article 111a of the Income Tax Law LIR. The maximum deductible amount is €3,200 per person, provided that your policy is for at least 10 years and that its term is between the insured person’s 60th and 75th birthday.

Single-premium Outstanding Balance Insurance (ASRD)

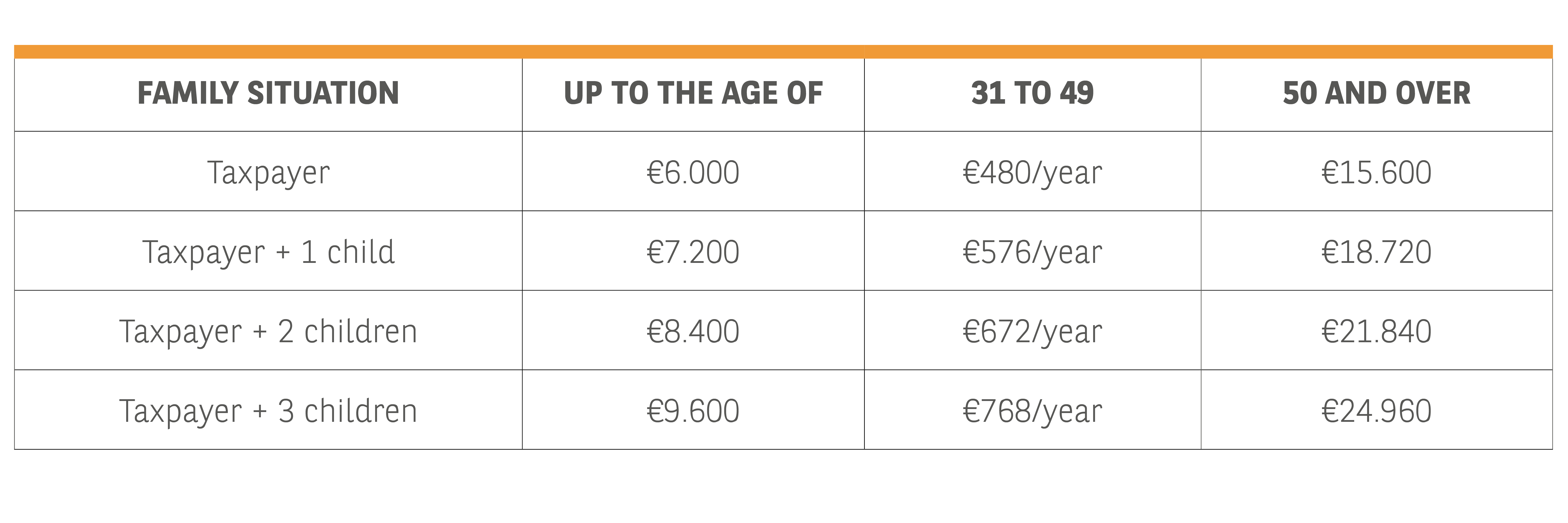

If you wish to cover your home loan with single-premium Outstanding Balance Insurance (ASRD), the tax-deductible limits are higher and are dependent on your family situation, your age and the number of children in your household.

Which of your products are deductible on your income tax return?

Luxembourg insurance offers numerous benefits ….

Certain insurance premiums are now deductible as special expenditure on your Luxembourg income tax return, provided that the limit imposed by Luxembourg regulations is not exceeded.

You are invited to come and discuss this with your usual contact at BGL BNP Paribas, an insurance agency for Cardif Lux Vie.

Mr and Mrs Doe, 36 and 33 respectively, are resident in Luxembourg. They have 2 children. Their taxable income is €90,000, so they are taxed €14,331.

They have a number of policies:

- Personal liability: €60/year

- Third Party Car Insurance: €800/year

- OptiSave+: €600/year

- Two OptiKids (premiums of €50 per month for each): €1,200/year

The total for these premiums is €2,660, being below the deductible limit of €2,688 (€672 x 4), under article 111 of the Income Tax Law LIR.

They also save for their retirement, each paying €3,200 into an OptiPension+ policy, the maximum amount deductible under article 111a of the Income Tax Law LIR.

Finally, they have just acquired their principal residence and have covered their home loan with Outstanding Balance Insurance (ASRD). So they can deduct up to €19,872, an amount greater than their premium of €16,000.

The total amount of deductible premiums is therefore €25,060. Their taxable income therefore goes down from €90,000 to €64,940.

Their former annual tax of €14,331 has been reduced to €6,388, representing a tax benefit of €7,943 (simulation on www.impotsdirects.public.lu)

* There are differences between French, German and Belgian cross-border workers.

**Spouses must be taxed jointly pursuant to article 109 para 1, 1a) of the Income Tax Law L.I.R.