Manager's comment

2021-01-06

A vaccine, a deal and a new president under the Christmas tree

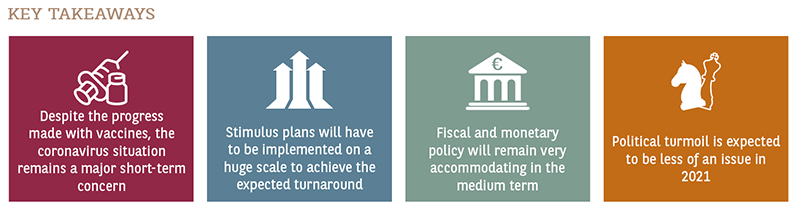

After spending the final weeks of 2020 hoping for an improvement in the Covid-19 situation and waiting to see how the various political dramas would unfold, investors actually ended the year feeling relatively relieved about the medium-term outlook. Indeed, despite the fact that the number of infections has, as feared, risen sharply in most Western countries over recent weeks, the confirmation that several vaccines will soon be available means that there is now light at the end of the tunnel and hope that social distancing rules can be relaxed during the second half of 2021. This would let the global economy recover in the way that many observers hoped to see when lockdowns were lifted at the end of the second quarter of 2020. Meanwhile, maintaining the unprecedented support measures introduced over the past year will be a key factor in avoiding any further deterioration in the economy at a macro or micro level at a time when many sectors (including tourism, leisure, transport and retail) are still completely shut down or operating at a reduced level.

Unsurprisingly, the 2020 growth rate figures are extremely negative for most of the developed countries, although the impact of the pandemic has varied greatly depending on how the crisis has been managed and the relative importance of the sectors that have been most severely affected. China, for example, is likely to be one of the only countries to have been able to record positive growth figures for 2020 with its economy expanding by around 2%. In contrast, world growth is expected to have shrunk by more than 3.5%. On the Eurozone side, GDP may well have fallen by as much as 7% (with Germany at -5/-6%, France and Italy between -9% and -10%). The growth figure for Japan is thought to be around -5%, with the economy in the United States “only” shrinking by 3.6% (due to a less strict lockdown than in the eurozone). For its part, the UK economy is likely to have been more severely affected given the very complex health situation there and the uncertainty generated by Brexit.

It is precisely the Brexit deal reached on 24 December that, over and above the encouraging new vaccines, constitutes a positive breakthrough at the 2020 year-end. While the framework for the future relationship between the EU and the United Kingdom in the services sector (and financial services in particular) still needs to be negotiated, the agreement reached guarantees duty-free and quota-free trade in goods provided that these comply with the “appropriate rules of origin”, and a compromise was also found on the contentious issue of fishing.

Joe Biden’s ultimately relatively clear-cut victory in the US presidential elections was another closely followed event at the end of the year with a high level of media coverage. The result, in contrast to the previous election, was as expected and despite Donald Trump’s desperate attempts to undermine the result, did not lead to clashes between supporters of two irreconcilable Americas. With regard to the US Congress, the House of Representatives remained in the hands of the Democrats, while the runoff elections in Georgia (5 January) also gave the President Elect control of the Senate. This should enable the new administration to push through some of the measures promised during the election campaign, notably through large-scale infrastructure investment to promote the energy transition. Pending the implementation of a bigger recovery plan, the Democrats and Republicans have agreed on new aid worth a total of $900 billion, which had helped in extremis to avoid a new “shutdown” of part of the American administration. This agreement has also enabled the direct payment of benefits to small businesses and to households whose unemployment benefits were due to expire at the end of December.

In this still very depressed context, the strength of the post-pandemic recovery will undoubtedly depend on the ability of the world’s major leaders to implement large-scale recovery plans so that the loss of growth as a result of the pandemic can be reversed (material and immaterial under-investment, reduced employability of young people, growing inequality etc.). From this perspective, central bankers will undoubtedly continue to play a key role by extending their quantitative support measures as a buffer against the exceptional increase in borrowing by businesses and by governments in particular. By way of illustration, public deficits in the eurozone are expected to approach 10% in 2020 and to continue to grow by an additional 7% in 2021, generating a dramatic increase in the debt/GDP ratio by more than 20 points to around 106%. As asset buybacks continue until at least 2022, the balance sheets of the major central banks (Fed, ECB, BoJ and BoE) will grow significantly to levels that have not been since the post-war period. The ECB’s balance sheet could reach 67% of the eurozone’s GDP by the end of 2021 (nearly €8,000 billion), while that of the Federal Reserve could approach the 40% mark. Furthermore, in the event of a return of inflation close to their target, some of them will wait until this target has largely been exceeded before questioning their current policy (cf. the Fed with regard to the symmetry around its 2% target).

What this means is that 2021 ought to be the year of recovery provided that vaccination roll-outs are fast enough to allow the global economy as a whole to open up again from the second half of the year. It is quite possible that the intensity of this recovery in 2021 will vary significantly from one country to another depending on the dominant economic sectors and national vaccination policies (or simply on their access to the various vaccines). Assuming there are not further significant setbacks, it is expected that those counties that have been hit hardest will bounce back the most vigorously, but are not likely to return to their pre-pandemic GDP levels until the end of 2022. On this basis, France is expected to experience growth of 5% with the US economy expanding by 4%.

From a political perspective, once the US Senate elections have been held on 5 January, this new year should be much less eventful, although the general election in the Netherlands in March and the federal elections in Germany in Q3 2021 could call into question the recent progress made towards European construction following the vote on the recovery plan. Besides, the more moderate positioning of Joe Biden, notably with regard to his European partners, should mean the avoidance of the type of tariff increase seen over recent years.

Despite the worsening coronavirus crisis and resulting lockdown measures in most of the developed countries, high-risk asset classes have been buoyed by news of effective vaccines (Pfizer/Bio-N-Tech, Moderna and more recently Astra Zeneca/Oxford). Consequently, the equity markets have rebounded strongly after experiencing a sudden drop at the end of October ahead of the US elections. They have successfully moved upwards and out of the channel in which they had been trading since early June. The European indices have thus almost managed to make up their losses, with the Eurostoxx 50 down by only 2.3% including dividends, despite having fallen by more than 25% during the first quarter. But the big winners, unsurprisingly, have been the American indices, driven by technology stocks and GAFAM (+Tesla) in particular. The Nasdaq and the S&P 500 thus largely exceeded their records reached last February and progressed by around 43% and 17% respectively over the year (in dollars). The Chinese (+26.4% for the CSI 300) and Japanese (+8.9% for the Topix) indices have also recorded a significant performance. Emerging markets also benefited from the comeback of equities, with the MSCI Emerging Markets Index gaining nearly 19% in 2020.

In the European bond markets, massive repurchases by Central Banks, combined with still very modest inflation expectations and extremely high levels of liquidity among most investors, have helped to keep government rates historically low and to compress Investment Grade and High Yield credit spreads. Germany’s 10-year bonds ended the year close to -0.6%, at -0.57%, after having moved in a narrow corridor of 20 bps around -0.5% over the last 6 months, down nearly 0.4% compared with the 2019 year-end. Peripheral spreads also eased significantly against Germany, with Italian and Spanish 10-year bonds ending the year at 0.54% and 0.04% respectively, while the Portuguese 10-year ended the year at 0% after a brief foray into negative territory. In this context, despite record issues and deteriorating fundamentals (higher leverage and default rates), credit spreads continued to narrow, ending the year on average in line with 2019 year-end levels for investment grade issuers and only slightly higher for the high yield and subordinated segments. Other asset classes such as emerging debt also benefited from the fall in risk-free rates (US 10-year rate at 0.92% compared with 1.92% at the end of 2019), the strong depreciation of the dollar against the main developed currencies (EUR/USD +8.9% to 1.2225) and the recovery in commodity prices (WTI oil price exceeds $45 per barrel).

With regard to the portfolio, after having carried out very significant volumes of transactions during the first half of the year, we were less active while the political uncertainty and coronavirus did little to encourage us to increase our proportion of risky assets after their valuations rebounded.

Our aim was therefore to maintain an equity exposure of close to 8%, while making tactical moves to re-expose or hedge when we considered market movements to be exaggerated.

In the bond markets, we continued to invest selectively in the primary credit market in order to increase our diversification and to achieve, where possible, a premium relative to the secondary market, particularly on unrated issues or bonds issued in euros by US companies. Our modified duration, which we manage by buying or selling “core” government securities, declined at the end of the period to close to the 4.7.

With regard to diversification, we made three additional investments in secondary private equity funds in order to take advantage of the macroeconomic environment and good diversification.

In infrastructure, we initiated an investment in renewable energy with the aim of being more directly involved in the energy transition.

In real estate, we invested in an open-ended fund in the social sector (education, healthcare etc.).

Furthermore, given the sharp narrowing of spreads experienced in recent months, we have preferred not to increase our exposure to high yield and emerging market debt.

Finally, due to the lack of opportunities in the final month of the year, our money market component stands at around 5% after having evolved between 3 and 4% throughout the second half of 2020.

At the beginning of this year, we are counting on the reopening of the primary credit market in order to relaunch our investments in this segment by favouring highly rated issuers with low cyclicality. We will act on any significant increase in risk-free rates to gradually raise our modified duration. We will take advantage of the weak dollar and a potential increase in US long rates to slightly increase our exposure to the US currency via bonds denominated in dollars.

In addition, if there is correction in the equity markets, we will revert to overexposure to the asset class, given its relative attractiveness, by maintaining our efforts to diversify geographically and/or in terms of style.

Similarly, we might increase our exposure to high yield, emerging debt and subordinated debt in the event of a marked widening of spreads. In contrast, we should steer clear of peripheral debt.

As it has been the case for many years now, it is worth remembering that all of our investments are screened through the lens of ESG criteria. In 2021, we will increase our exposure to “sustainable” bonds and continue to seek out projects with a positive impact that make financial sense.

François LUCCHINI - Director of Asset Management