The reform of article 8 IHT in the Walloon and Brussels-Captial Region. Its impacts on certain life insurance policies.

The reform of article 8 IHT in the Walloon and Brussels-Captial Region. Its impacts on certain life insurance policies.

2021-02-04

On January 7th, 2021, the tax authority issued Circular 2021/C/2 (hereafter referred to as “the Circular”) on the application of article 8 of the Belgian Inheritance Tax Code and the tax arrangements applicable to certain categories of life insurance policies. The Circular only covers the Walloon Region and the Brussels-Capital Region and applies to all deaths that have occurred since September 1st, 2018.

The Circular was issued following the reform of matrimonial property regimes by the law of July 22nd, 2018, which entered into force on September 1st, 2018. This law alters the tax arrangements for life insurance policies taken out by individuals married under the community of property regime.

1. Life insurance policy

The tax authority distinguishes between:

- Pure insurance policies: insurance in the event of death

- Mixed life insurance policies: insurance on survival OR on death

- Insurance policies taken out by two policyholders and/or two lives assured: joint policy and/or two lives assured with settlement on the second death

- Assignment of rights under articles 183 and 184 of the law of April 4th, 2014

2. Purpose of article 8 of the Belgian Inheritance Tax Code

The tax authority stresses that “the taxation of the fictitious legacy laid down in article 8 (1), (2) and (4) of the Inheritance Tax Code is intended to cover ‘the sums, annuities or securities’ that a person is due to receive. It is irrelevant therefore whether the surrender value of a life insurance policy is regarded as specific to a particular spouse under the Civil Code, since the surrender value is not the object of the fictitious legacy” (Section 3.1, paragraphs 1 and 2 of the Circular).

We have provided a few practical examples below to illustrate the impact of the Circular.

3. Practical examples

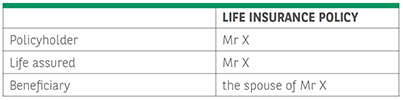

3.1. Life insurance policy taken out by a person on his life for his benefit and for the benefit of his spouse

Life insurance policy I: there is no third-party beneficiary, so article 8 of the Inheritance Tax Code does not apply. However,

the capital paid is taxable in respect of the deceased’s estate on the basis of article 1 of the Inheritance Tax Code.

Life insurance policy II: the capital paid is subject to inheritance tax, although the tax base will vary depending on the

spouses’ matrimonial property regime:

- separation of property regime: all capital paid to Mr X’s wife will be subject to inheritance tax. Mr X is deemed to have paid the insurance premiums using his own funds. Mrs X still has the option of proving otherwise.

- community of property regime: inheritance tax will be payable on half of the capital paid to the spouse of Mr X under article 8 (4) of the Inheritance Tax Code:

- the premiums are deemed to have been paid using funds belonging to both spouses;

- if the spouse of Mr X can show that the premiums were paid with funds belonging to her (i.e. her own funds), the death benefit will not be subject to inheritance tax.

3.2. Souscription d’un contrat d’assurance vie mixte

- If Mr X dies more than three years after the agreed maturity date, there will be no inheritance tax. If they are married under the community of property regime, article 1405(1) (8) of the Civil Code applies.

- If Mr X dies within three years following the maturity date of the insurance policy, inheritance tax will be due under article 108 of the Inheritance Tax Code.

- If Mr X dies before the insurance policy matures, the capital paid will be subject to inheritance tax. However, the tax base will vary depending on the spouses’ matrimonial property regime.

- separation of property regime: all capital paid to Mr X’s wife will be subject to inheritance tax. Mr X is deemed to have paid the insurance premiums using his own funds. Mrs X still has the option of proving otherwise.

- community of property regime: inheritance tax will be payable on half of the capital paid to the spouse of Mr X under article 8 (4) of the Inheritance Tax Code:

- the premiums are deemed to have been paid using funds belonging to both spouses;

- if the spouse of Mr X can show that the premiums were paid with funds belonging to her (i.e. her own funds), the death benefit will not be subject to inheritance

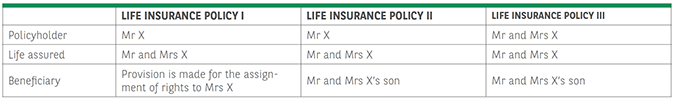

3.3. Souscription d’une assurance vie par une (deux) personnes en faveur d’une tierce personne – Liquidation au dernier décès

Life insurance policy I: the capital paid is subject to inheritance tax, although the tax base will vary depending on the spouses’ matrimonial property regime:

- separation of property regime: all capital paid to Mr X’s wife will be subject to inheritance tax. Mr X is deemed to have paid the insurance premiums using his own funds. Mrs X still has the option of proving otherwise.

- community of property regime: inheritance tax will be payable on half of the capital paid to the spouse of Mr X under article 8 (4) of the Inheritance Tax Code:

- the premiums are deemed to have been paid using funds belonging to both spouses;

- if the spouse of Mr X can show that the premiums were paid with funds belonging to him (i.e. his own funds), the death benefit will not be subject to inheritance tax.

Life insurance policy II: Mr and Mrs X’s son is liable to tax on the surrender value under article 8 (2) of the of the Inheritance Tax Code.

Life insurance policy III:

- death of Mr X: inheritance tax will be payable by Mr X and Mrs X’s son on the portion of the premiums paid by Mr X (article 8 (2) of the Inheritance Tax Code).

- death of Mrs X: inheritance tax will be payable by Mr and Mrs X’s son on the portion of the premiums paid by Mrs X (article 8 (1) of the Inheritance Tax Code).

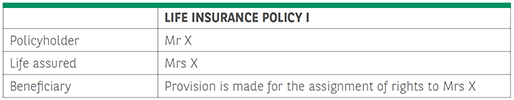

3.4. Cession des droits

Upon Mr X’s death – even if the insurance policy is not liquidated – the surrender value is subject to inheritance tax under article 4 (3) of the Inheritance Tax Code.

If you have any queries on this subject, please get in touch with your usual contact person.

Wouter OSTYN - Senior tax & legal advisor